Your Futuristic New Wallet: 6+ Easy Ways to Pay with iPhone

Credit: Denys Prykhodov / Shutterstock

Credit: Denys Prykhodov / Shutterstock

It’s 2018 and leather wallets are becoming a thing of the past as our iPhones make it easier and easier to pay. We’re not talking about in-app purchases, we’re referring to using your iPhone to make real-world purchases, in-store, peer-to-peer, and online.

For a lot of people this is already the norm, but there are still plenty of people (and plenty of retailers) that aren’t getting on the mobile payments train. If you’ve been holding out—or if you want to expand your arsenal of mobile payment options—there are many options available that might interest you. Continue reading to learn about Your Mobile Wallet: 6+ Ways to Pay with iPhone.

6 Apple Pay (Wallet, Online, and Cash)

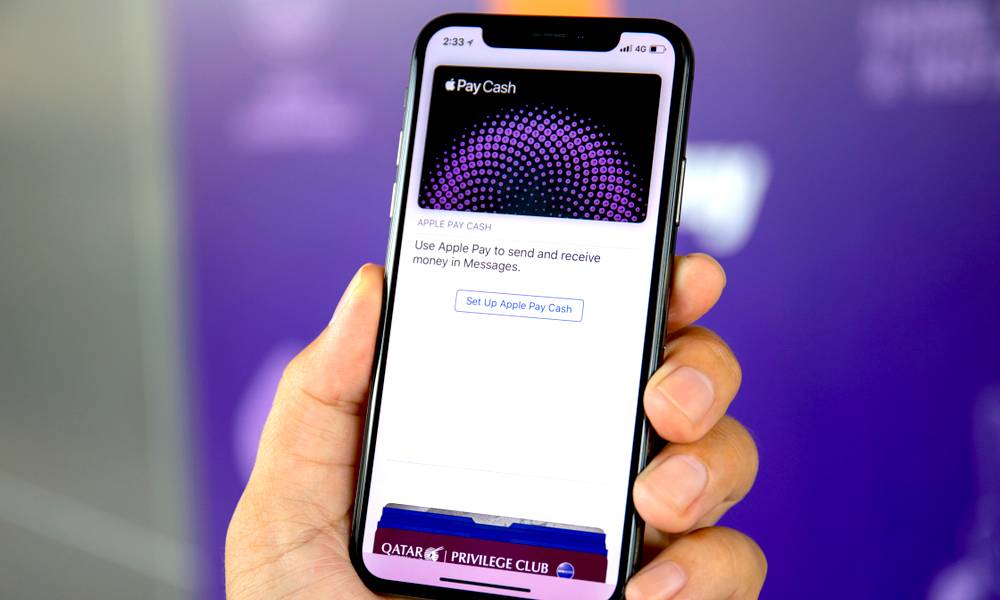

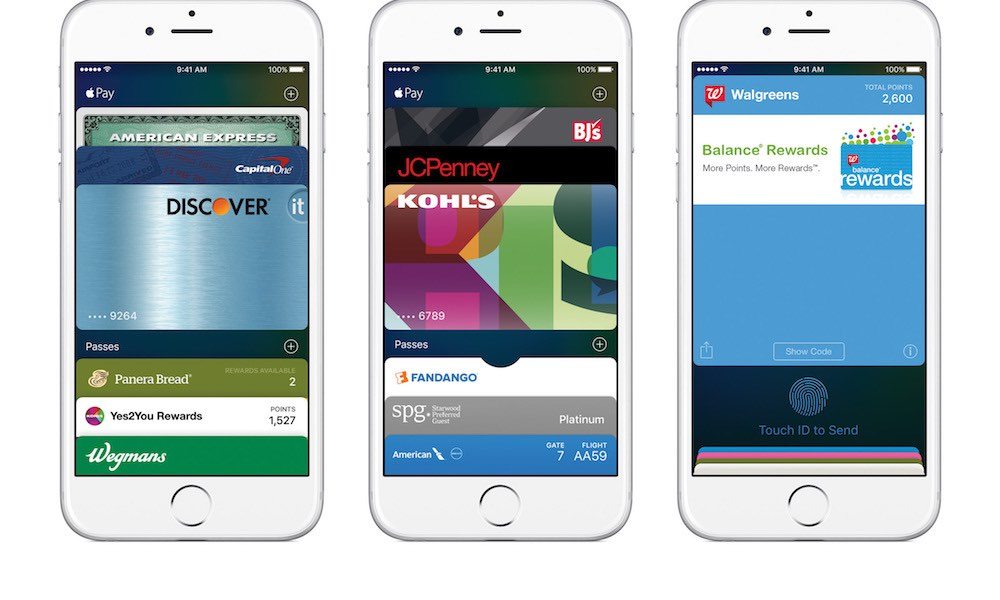

Wallet and Apple Pay are integrated into iOS and are ready for you to set up and use. Wallet is home to all of your payment cards and passes. You can add movie tickets, boarding passes, loyalty cards, and more. Some passes—such as Starbucks and Walgreens—will let you make payments and earn points from Wallet as well. The cards added to Wallet can be used with Apple Pay.

Many people know Apple Pay as that NFC payment feature that only works at a few locations. But it’s much more than that and it’s being accepted more and more places.

To start with Apple Pay, add a supported payment card (or cards) using the Wallet app. You can use the camera to easily scan your credit or debit card.

Once your card is activated, it will be shown in the Wallet app and you’ll be able to tap your iPhone (or Apple Watch) on designated readers to make a payment. On iPhone, payments are secured by your face or fingerprint.

Wallet can be accessed by double-clicking the home button when your iPhone is locked, or side button on iPhone X.

Doing so will instantly show your default payment method; and, you can swipe up to see your other passes and cards.

To access Wallet on an Apple Watch, double click the side button. Some passes are location aware. For example, movie tickets purchased in Fandango will appear on the lock screen when you get to the theater.

You can disable this for individual passes by clicking the circle with three dots in the bottom right corner of the pass.

As well as being location aware, some passes are also dynamic and can update automatically. For example, you can view the balance on a gift card or the points you’ve earned on a loyalty card. Passes are shareable, so you can share a movie pass or rewards card with your family or friends.

In addition to contactless payments, you can use cards setup in Apple Pay in some apps and websites. When implemented properly, this speeds up the checkout process since you don’t need to login, register, or fill out shipping information. Just tap, authenticate, and go.

In iOS 11, Apple introduced Apple Pay Cash. Cash allows users to send and receive money through iMessage. Money can be sent using one of the payment cards in Wallet. When money is received it is stored on a virtual Apple Pay Cash card, which is also found in Wallet. You can use this card to make contactless payments, send money to other users via iMessage, or transfer money to your bank account. You can also reload the card at anytime.

Apple Pay Cash can be set up using a supported device. Just go to Settings > Wallet & Apple Pay and tap Apple Pay Cash card.

Who is it for?

Anyone who needs a place to keep their ever-growing pile of cards. With the Wallet app everything stays in one easily accessible place, meaning you can finally say yes to that cashier who wants you to sign up for a rewards card. The Apple Pay Cash card simplifies life by allowing payments to be made between friends, online, or in the store.

Key Features of Wallet with Apple Pay

- One place for all of your cards.

- Easy access and location-based notifications.

- Easily share tickets and rewards cards with friends and family.

5 PayPal

One of the oldest—and probably the best known—service for making payments, PayPal has evolved from its simple eBay transaction roots and now offers a quick and easy way to send and receive payments between friends and online retailers.

PayPal integrates with a variety of services and is available in over 200 markets. With over 244 million active users as of 2018, PayPal is one of the largest online payment services. The company also offers a PayPal cash card that allows users to spend or withdraw funds directly from their PayPal balance.

PayPal is simple and works by connecting a supported bank account. Users can easily add contacts to send and request money. A money pool feature allows users to collect money from friends and family in cases such as shared expenses, fundraising or a group vacation or gift. PayPal even has options for donating charity or ordering and paying for local takeout.

Who is it for?

People who want multiple features in a mobile payments app. PayPal has more features than just sending and receiving money.

Key Features

- Instant Transfer.

- PayPal Cash Card.

- Worldwide currencies.

- Money Pool.

- Local Food Ordering.

Download PayPal on the App Store

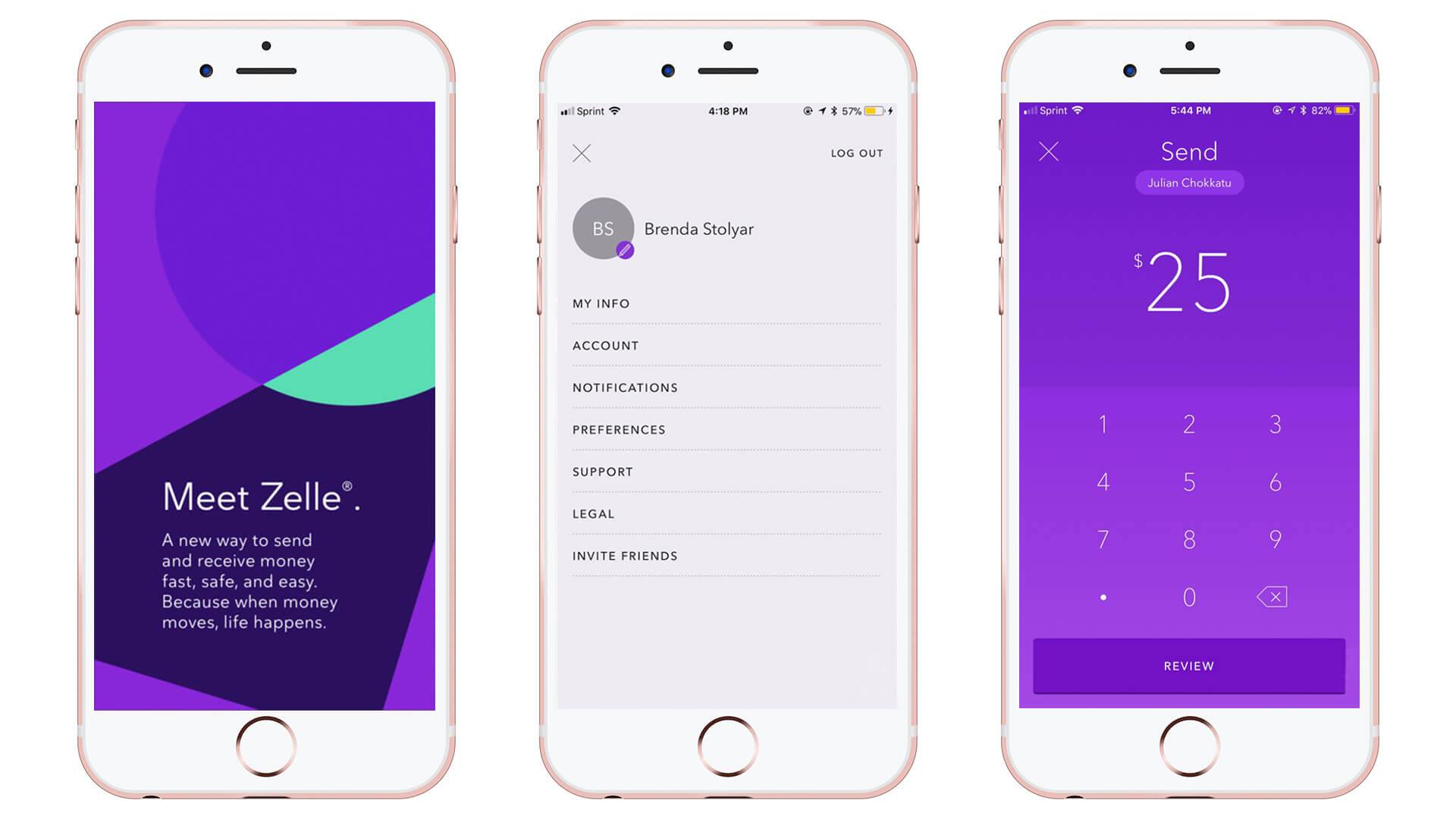

4 Zelle

An alternative to the multiple other money transfer apps out there Zelle does things a little differently. Instead of keeping your money in the app, Zelle transfers money directly from one bank to the next. There isn’t any “in-between space” for your money. If your bank supports Zelle, money will generally transfer within the same day.

To get started, simply connect your bank to the app, or sign up through your supported bank. Once a bank account is connected you can easily send and receive money to and from other users.

Who is it for?

Users who want to send money back and forth without using a separate account.

Key Features

- Instant transfer from bank to bank.

- Multiple supported banks.

Download Zelle on the App Store

3 Cash App

Cash App, by Square, is a simple and easy way to send a receive mobile payments. Users can request funds from others, send payments and easily receive them. Cash App recently rolled out a new feature that allows its users to trade bitcoin and also supports ACH direct deposits. In addition, its business friendly; allowing both business owners and individuals to send and receive money using a user handle called a $cashtag.

Users can transfer money from one Cash account to another using the app. If one of the users in a transaction doesn’t have the app, the money can be sent via an email address and the receiver will be able to sign up to make a transfer. Users can transfer their funds in the app to their personal bank account or sign up for a free Cash App debit card where fund are withdrawn directly from the app. Using the bitcoin section, users can monitor the current value of the cryptocurrency and easily buy and sell from within the app.

Who is it for?

People who want an easy way to send and receive money. It also has a specific category for business owners. If you’re looking for an easy way to buy, store, and sell bitcoin, Square’s Cash App is a great solution.

Key Features

- Easily send and receive money.

- Free debit card.

- Trade bitcoin.

- ACH direct deposits.

- $Cashtag for businesses.

Download Cash App on the App Store

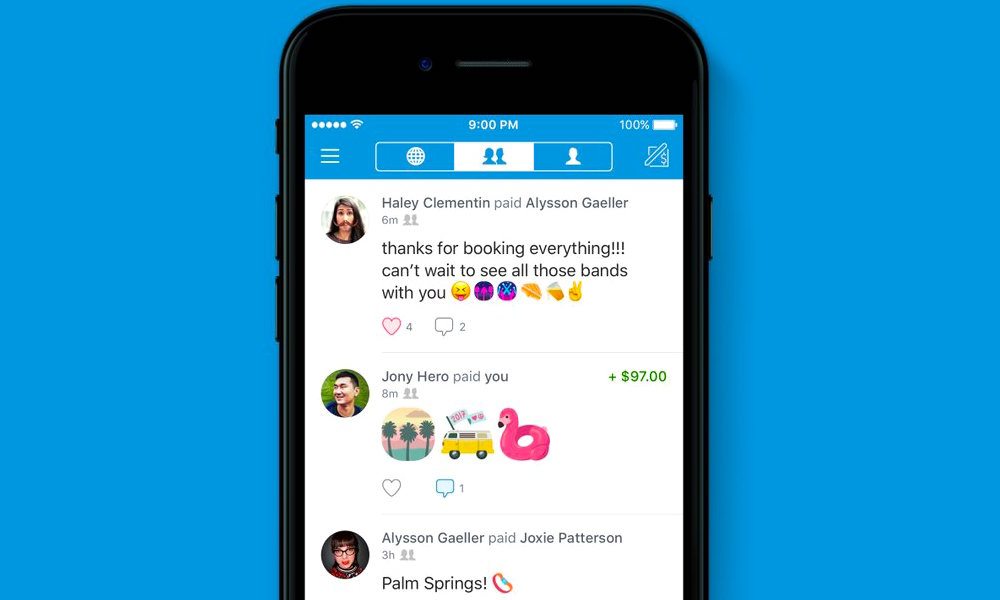

2 Venmo

An app for sending and receiving cash between friends and shopping online, Venmo is a popular payments app with a social aspect. The app shows recent transactions between friends—and others around the world—in a social feed. Users can opt to publish transactions publicly or keep them private. It also includes an instant transfer feature which allows users to move their funds to a supported bank in as little as 30 minutes (with a $0.25 fee).

Venmo is easy to use and connects to your bank account, credit card, or debit card so you an easily send and receive money. Money can be kept in the Venmo account to use for later, or users can cash out immediately. They recently introduced a new Venmo MasterCard which users can request. The card withdraws money directly from a Venmo account or any supported ATM. If a user doesn’t have enough funds to cover a transaction, they will automatically be added from a supported bank in $10 increments.

Venmo (owned by PayPal) is also supported online anywhere you see “Pay with PayPal.” Users can choose to pay from a linked account or with the funds from their Venmo account.

Who is it for?

Anyone who wants a quick and easy way to send a receive cash. It also offers a debit card option for users who would like to use it as an alternative bank account.

Key Features

- Social Feed.

- Instant Transfer.

- MasterCard Debit Card.

Download Venmo on the App Store

1 Shopping Apps

Paying at your favorite spots is easier when you use an app. Multiple fast-food chains, restaurants, gas stations, coffee shops, retail stores and more let users pay and order right from their phones.

For example, the Starbucks app lets you link your rewards card and browse the menu. You can show the barista your card in-app or add it to the Wallet app for easy access. Scan your card for rewards, or to pay from your Starbucks balance. Additionally, you can order and pay from the app and then pick up your order at the store.

Similar places with similar payment apps include McDonald’s, Dunkin’ Donuts, and Sonic Drive-In. Your options are not just limited to fast food chains, Outback Steakhouse also offers users an option to pay their check straight from the app. Aside from food, users can also pay at the gas pump straight from their phone. Exxon Mobile and Shell are some of a few gas stations offering mobile payments, making your life a little easier at the pump.

Most payment apps connect your bank account to their app. In some cases transactions are handled directly from your account, while others may need to be reloaded automatically or manually. Some apps allow you to order ahead, pay in-person, or both.

Who is it for?

Anyone who wants to simplify life and use a phone in place of a wallet. Check the apps of your favorite places to see what is offered.

Key Features

- Order Food or Fuel

- Pay for items in app

Download Exxon Mobil Speed Pass+ on the App Store

Download Outback Steakhouse on the App Store

Download Starbucks on the App Store

Download McDonald’s on the App Store

Download Dunkin’ Donuts on the App Store

So Many Ways to Leave Your Wallet at Home

While you still may need your wallet for things like your ID. The digital wallet is becoming more and more practical and is quickly being rolled out to more places. If you have a service that you’d like to recommend, please share it with our readers in the comments or on social media.