Yikes! Apple Loses $100 Billion in Share Price Drop

Credit: katjen / Shutterstock

Credit: katjen / Shutterstock

Toggle Dark Mode

Apple (APPL) lost nearly $100 billion in market cap as shares slid $6.49 today. Apple opened trading at $222.50 per share but closed at $216.01 per share, a loss of nearly 3%. Just a couple of weeks ago, analysts were bullish on Apple in anticipation of iOS 18, the iPhone 16 launch, and Apple Intelligence. What drove today’s loss, and will Apple recover?

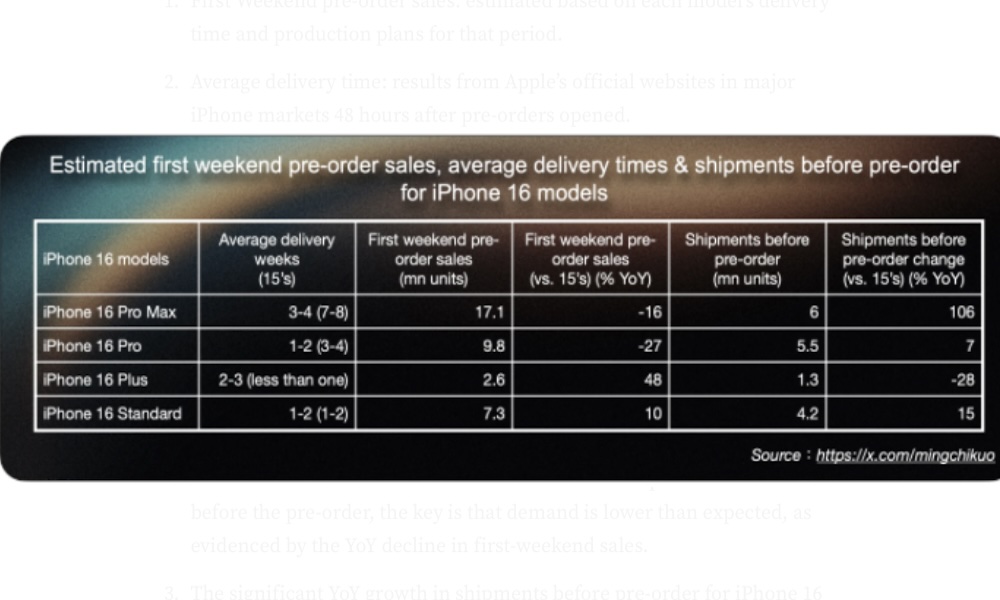

The main factor in today’s price drop is a report that iPhone 16 first-weekend preorders were down about 12.7% from last year’s iPhone 15 release pre-orders. Interestingly enough, a critical factor in the lower demand is likely that the iPhone 16 wasn’t released alongside Apple Intelligence.

While it’s easy to view this decision by Apple as a mistake in a vacuum, time will tell. Although initial demand for the iPhone 16 is lower than the previous model, delivery time is quicker with this year’s iPhone 16 Pro. Maybe getting new iPhones in people’s hands faster will generate more demand. Or does faster delivery accurately forecast less demand?

Interestingly, Bank of America’s Wamsi Mohan still stands by his “buy” rating for Apple stock based on the anticipated AI-driven upgrade cycle, which will be a multi-year process. Mohan seems less concerned about shorter shipping times signaling lower demand as the analysis is much more complex, especially taking into account data for other countries like China, where Apple Intelligence won’t be available in Chinese until next year. On top of this, Apple may have improved overall supply chain efficiency.

There’s no doubt that the stakes are high for Apple and the iPhone 16. There are still predictions for record iPhone sales in Q4 and estimates of strong year-over-year growth in iPhone sales revenue. When it comes to the most valuable company in the world, giant numbers like a $100 billion loss in market cap may seem shocking at first. At the same time, it’s possibly a red herring as many analysts are betting Apple’s new iPhone and AI will drive equally staggering growth in the future. Consult your financial advisor before deciding to take the ride.