QuickBooks Embraces Tap to Pay on iPhone

Credit: Apple

Credit: Apple

Toggle Dark Mode

A little over three years ago, Apple announced Tap to Pay on iPhone, flipping the Apple Pay script to allow small business owners to use the iPhone to receive payments with the same NFC technology that customers use to make them.

However, unlike Apple Pay, Tap to Pay on iPhone wasn’t inherently built into Apple Wallet. Instead, it was a framework the company opened up to allow third-party developers to take advantage of the iPhone’s contactless payments hardware to handle incoming funds. Like most such initiatives, Apple launched with key partners like Stripe and Shopify, and it didn’t take long before others came on board.

Even Square, the company that arguably brought mobile vendor payments mainstream with its portable mag-stripe and contactless iPhone accessories, decided to cut out the hardware middlemen and let its apps work directly with Apple’s Tap to Pay on iPhone. Square always made most of its money from merchant fees — the cut it takes from every credit card transaction. It used to give away its headphone jack-connected mag-stripe readers, and likely sold the contactless ones at a break-even point.

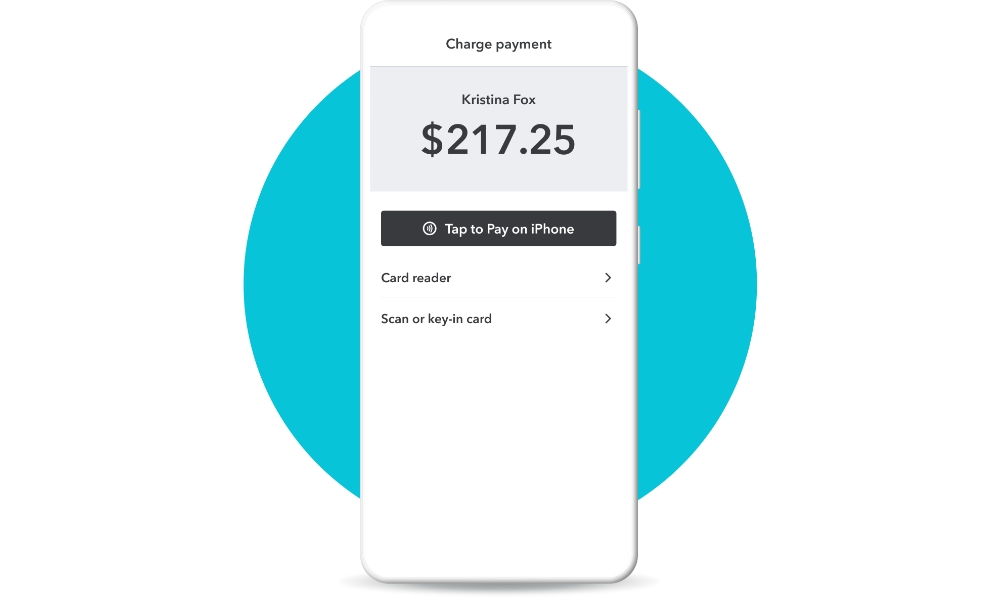

Now, Intuit is joining the club with what promises to be an even more seamless solution for businesses that use its popular accounting software, QuickBooks. While solutions by Stripe, Square, and Shopify work very well with Tap to Pay on iPhone, they’re still standalone solutions. Some are tied into some pretty strong point-of-sale and inventory systems, but rarely have a full bookkeeping system behind them.

That’s where QuickBooks has a leg up. Any business that’s already using QuickBooks Online — which is over 6 million of them — will be able to take advantage of Tap to Pay on iPhone without needing to set up any secondary apps or payment services.

With Tap to Pay on iPhone, we’re giving customers a competitive advantage that accelerates cash flow, business growth, and customer loyalty. What makes Tap to Pay on iPhone unique for QuickBooks customers, is that it allows them to streamline their in-person payments and seamlessly connect them to their books and our end-to-end services, putting their full business finances all in one place.

David Hahn, SVP, QuickBooks Money Platform

QuickBooks Online is predominantly used by small and medium-sized businesses, which makes it even more welcome. Smaller companies don’t always have the resources to manage multiple systems to accept contactless payments. Using another service requires maintaining separate accounting information, and things like bank account access need to be configured and verified separately.

With Intuit’s solution, businesses who want to start accepting contactless payments on the iPhone can install the QuickBooks mobile or GoPayment apps and be ready to go in a few minutes. You’ll need to configure Quickbooks Payments if you’re not already using it, but that’s a free add-on for most QuickBooks plans, and most companies already have all their financial information in Quickbooks Online.

Once it’s set up, payments made through the QuickBooks apps are automatically recorded in QuickBooks Online, taking advantage of the accounting software’s auto-categorization and reconciliation features so your books will always be up to date without needing to transfer data from another point of sale system.

QuickBooks Payments also charges lower fees than many competing services, such as Square. For example, an in-person Tap to Pay on iPhone transaction costs only a flat 2.5%, compared to 2.6% plus $0.10 per transaction with Square or 2.7% plus $0.05 per transaction with Stripe.

Sadly, Tap to Pay on iPhone is only coming to QuickBooks Online customers in the US for now (sorry, Canada). It’s rolling out today, but it may take some time before it’s available for everyone. Intuit says it should show up “in the coming weeks” for everyone with a QuickBooks Payments plan added to their subscription.