Apple TV+ May Be The Craziest Loss Leader Ever

Credit: Hadrian / Shutterstock

Credit: Hadrian / Shutterstock

Toggle Dark Mode

Artificial intelligence isn’t the only place where Apple seems to be struggling. A new report reveals that its Apple TV+ subscription service is also woefully unprofitable, operating at a loss of more than $1 billion annually.

This new revelation comes from The Information’s Wayne Ma, who notes that Apple TV+ is the only one of Apple’s subscription services that’s been losing money, but it’s losing it by the buckets while the rest are all turning at least a small profit.

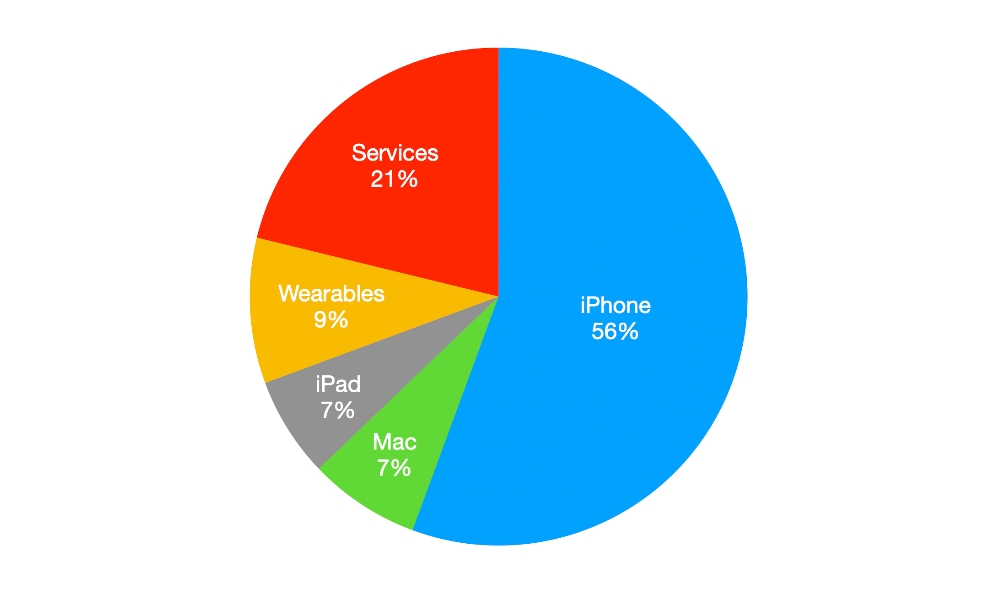

Apple’s Services business continues to show dramatic year-over-year increases despite these losses. The company reported $23.1 billion in services revenue in the most recent holiday quarter (Q1 2025) — a 13.9% increase over the same period the year before and a 21% share of the company’s overall revenue that now rivals Wearables, iPads, and Macs all put together.

While nobody has ever assumed that a significant share of that services business came from Apple TV+, as this category includes App Store revenue and the multi-billion-dollar search deal with Google, most speculated that Apple was more or less breaking even. There were reports that it wasn’t profitable, but nobody seemed to expect it to make tons of money, either.

Unlike rival streaming giants like Netflix, Max, and Disney+, Apple is still in the business of selling iPhones. Those accounted for 56% of its revenue in Q1 2025 — more than twice as much as services. That gives it a a luxury that its rivals don’t have: room to coast and be more picky about the content it bankrolls.

It’s always been assumed that Apple TV+ was something of a “loss leader” — a value-added service to help attract more folks into the Apple ecosystem. Not that anyone is buying an iPhone with Apple TV+ in mind, but it helps sweeten the pot while getting Apple’s name out there even more.

Still, one billion dollars every year is a heck of a loss leader — even for a $3 trillion company.

It’s a small wonder that Apple has been cutting budgets and exploring new monetization strategies over the past year. After spending $700 million on three blockbuster films that received a lukewarm reception at the box office and failed to win any Academy Awards, reports surfaced that the company was tightening its purse strings for original productions, reducing budgets for existing productions, being even more cautious about new content, and more summarily cancelling shows that weren’t performing as well.

That’s a stark contrast to the sunny days of 2019. When Apple TV+ first launched, it was reportedly spending $15 million per episode for some Apple TV+ shows like See and The Morning Show. A 10-episode season could easily run $150 million, rivaling the budget of many feature films.

Apple also appears to have given up on its dream of winning Oscars and Emmys to become a mover and shaker in Hollywood. The company scored a history-making Best Picture Oscar for CODA in 2022, but it now seems satisfied with having that single win under its belt. Over the last year, it’s retreated from the ambitious theatrical release strategy where it once planned to spend $1 billion per year to bring its films to the big screen.

Although 2023 blockbusters like Killers of the Flower Moon at least received some Oscar nominations last year, Apple was shut out entirely for this 97th Academy Awards. That’s not because its 2024 releases didn’t qualify; Apple simply fell back to doing “token” theatrical releases to meet the minimum Academy requirements (much to the chagrin of some directors, who felt blindsided by Apple’s sudden shifts).

Perhaps, like its dance with the fashion industry of the early Apple Watch era, Apple’s fascination with Hollywood has passed. Or, maybe it is really just about the money. Apple TV+ still plans to try its hand at one or two big blockbusters each year — Brad Pitt’s F1 is still getting a big theatrical release — but most other films, even those with popular leads like George Clooney and Brad Pitt, will follow the model of Apple’s rivals, opting for limited theatrical runs while simultaneously debuting on Apple TV+.

Meanwhile, Apple has been looking for other ways to monetize Apple TV+, including licensing its movies to other streaming services, offering it through Amazon Prime, and moving beyond “Apple Originals” to license a catalog of non-original content to draw in more subscribers.

Recent shows have also done well, with Severance bringing in record viewers and becoming popular enough for Google to add a hidden easter egg. Apple also undoubtedly hopes the return of the Emmy award-winning Ted Lasso will also spark more interest and result in more sign-ups, especially with an Android app now available.

What About Apple’s Other Services?

While Apple TV+ is losing money at a seemingly alarming rate, the rest of Apple’s customer-focused services aren’t exactly printing money for the company either.

According to The Information, Apple Music is essentially stagnant and “only marginally profitable.” Apple pays about 70% of its Music revenue to artists and labels, and the service is no longer growing as the market is now effectively saturated. Sources say Apple services boss Eddy Cue has admitted that it’s unlikely the service will ever hit 100 million subscribers.

Unsurprisingly, Apple News+, Apple Fitness+, and Apple Arcade aren’t doing exceptionally well either. These services never saw massive sign-ups, and individual subscribers and active users for both are well under 10 million. Only iCloud+ seems to be doing well, likely driven by Apple’s paltry 5 GB of free storage being effectively useless, forcing folks to upgrade or look elsewhere for cloud storage.

Even so, most of the subscribers to these services are coming via Apple One bundles, which are driven primarily by interest in iCloud+ and Apple Music; other services like Apple Arcade and Apple TV+ are merely along for the ride, and the same applies to Apple Fitness+ and Apple News+ for those who opt for the Apple One Premier plan. These bundles keep most of Apple’s less popular services profitable, but games and fitness videos don’t cost nearly as much to produce as movies and TV shows.