6 Ways the Apple Card Protects You from Data Miners

Credit: Melvin Thambi

Credit: Melvin Thambi

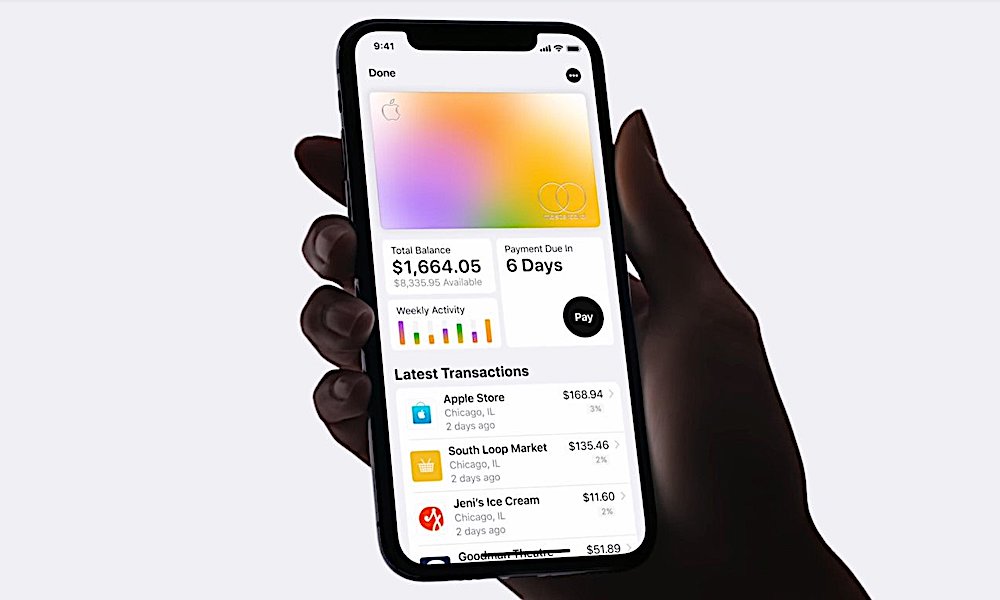

The Apple Card is already one of the most secure credit cards on the market. But is it private? Privacy and security are closely related, but they still differ in many key areas.

As The Washington Post’s Geoffrey Fowler noted in a recent piece, most credit cards are pretty poor when it comes to protecting your privacy. And that’s because there are a lot of interested parties who are after your data.

The Apple Card isn’t perfect when it comes to privacy, but it is a lot better than most other cards. Continue reading to learn 6 Ways the Apple Card Protects You from Data Miners.

Apple Pay Dodges "Customer Profiles"

When you pay in a store, the swipe of a credit card can generally be tied back to you. Major retailers like Target or Walmart, for example, link your credit card to a “customer profile” of you. And that’s not counting point-of-sale system manufacturers like Verifone or Square, who also get a slice of your data.

There isn’t any surefire defense against these types of data harvesting tactics, but if you use the Apple Card with Apple Pay, you do have an advantage. That’s because Apple Pay doesn’t require that you share your actual card number with these point-of-sale systems. Instead, Apple Pay uses a unique device identifier for transactions.

Apple Doesn’t Store Your Data

The Apple Card is thoroughly an Apple product. And while you may expect Apple to have minute control over every aspect of the Apple Card experience, the company actually isn’t involved with your data at all. This is vastly different from other co-branded cards from the likes of Amazon or other firms.

True to Apple’s privacy stance, the company doesn’t send your Apple Card data to its servers. Instead, spending summaries and financial data is generated and stored locally on your device. As Apple notes on its Apple Card privacy page, the company “doesn’t know what you bought. Or where. Or how much you paid.”

Goldman Sachs Won’t Sell It

While Apple won’t have any sort of record of your transactional history, its primary bank partner will. All of your Apple Card data will bypass Apple and go to Goldman Sachs. For privacy advocates, that could be a concern — since many banks have terrible privacy policies. Luckily, Goldman Sachs is a bit different in this case.

Apple has apparently had Goldman Sachs agree to a no-data-selling policy. That means that the bank won’t share or sell your data to third parties for advertising and marketing services. Your data will be reported to credit agencies for score calculation. But Apple Card is a credit card, so that’s to be expected.

Online Protections

When you go online, there are plenty of data harvesters who are after your information. Just take a look at Google or Intuit Mint. When you get a receipt in a Gmail account, Google adds it to a purchase database. And Mint uses all of your financial data to market to you within their app.

Apple Card does away with some of these threats. For one, it doesn’t support third-party financial apps like Mint — instead, financial health is done through the Wallet app. Apple Card numbers used for online transactions are also only semi-permanent, meaning you can request a new one if you feel like your privacy or security is in jeopardy.

Physical Protections

It’s worth noting that the physical Apple Card doesn’t sport some of these privacy-protecting features. It still technically has a physical card number (though you won't be able to see it) and it’s vulnerable to data skimming attacks like any other magnetic strip-based credit card. (If you’re worried about the latter, invest in an RFID-blocking sleeve.)

But the Apple Card does do privacy and security well for a physical credit card. There are no numbers on the actual face of the card and the card number itself doesn’t appear to be attached to any of the temporary numbers you use online or via Apple Pay. It doesn’t prevent you from leaving a digital footprint, but it could help confuse data miners.

MasterCard Will Scrub It

If the Apple Card has a weak spot when it comes to privacy, it’s the fact that Apple’s card network partner is MasterCard. Most card networks do share customer information with third-parties. In MasterCard’s case, the company reportedly has an agreement with Google to share data.

Apple, for its part, doesn’t mention MasterCard’s privacy policies on its site. But MasterCard itself said it only shares anonymized and aggregated user data, meaning that an individual purchase shouldn’t be linked back to you. It isn’t a perfect solution, but it’s there.