7 Reasons Why You Should Buy Apple Stock Now

Credit: Anna Hoychuk / Shutterstock

Credit: Anna Hoychuk / Shutterstock

As a publicly-owned, worldwide leader in technology, innovation and design, Apple’s stock (traded under the NASDAQ ticker symbol, AAPL) has endured a wild ride over the years.

From its Initial Public Offering (IPO) of just $22 per share back in December of 1980, to the tech giant’s unprecedented growth, resulting in massive, per share gains in the years since, there’s no wonder why some analysts believe Apple is on track to become the world’s first trillion-dollar corporation.

But amid its recent volatility — ups and downs, which were prompted in part by a stellar but still underwhelming fourth quarter earnings report — some investors might be feeling particularly cautious, wondering if Cupertino has any room left to grow in the years to come.. Use the Right Arrow to Learn 7 Reasons Why It’s a Great Time to Invest In AAPL.

7 iPhone X and Beyond

Reports have so far shown that iPhone X demand might not be as high as Apple initially expected, resulting in major component order reductions and an overall slump in its sales forecast. KGI Securities analyst, Ming-Chi Kuo, however, in one of his latest research notes predicted the tides may soon begin to turn in Apple’s favor.

The company is expected to release a plethora of next-generation iPhone models this year, potentially prompting what some analysts have described as a ‘Supercycle’ of iPhone upgrades. And of course, that spells sales, revenue, and bottom-line gains per share for investors.

6 It Pays Dividends

In light of its massive growth and success, Apple’s board of directors made the call in early 2012 to begin doling out quarterly, per-share dividends to its shareholders.

While the payout isn’t exactly record-shattering at a variable amount of [less than] $1/per share, per quarter, for those who own or opt to purchase a reasonable number of them, you’ll not only stand to benefit from any future growth, but reap a quarterly bonus right off the top.

5 Enterprise Growth Potential

A recent IDC survey revealed that in the coming years, some organizations in the enterprise sector plan to spend as much as half their annual IT budgets upgrading their employee’s mobile and computing hardware.

That taken into consideration, Apple has a grand opportunity to capture a larger slice of the enterprise market, particularly through its sales of new iPhone models and Mac computers in higher quantities.

4 Stock Splits

To gauge an idea of just how successful Apple is, financially, one need only consider the many stock splits approved by its governance over the years.

Defined as a company’s issuance of new shares to existing shareholders in proportion to their current holdings, Apple has initiated a number of stock splits, including its latest (and highest) 7-1 split authorized on June 9, 2014, which resulted in shareholders being issued 7 new shares of AAPL per every 1 share they owned prior to the split date. Could it happen again? Well, certainly. But only time will tell..

3 Tax Reform & U.S. Investment

Apple currently has as much as $250 billion in offshore cash holdings. Thanks in large part to the Trump administration’s U.S. Tax Code overhaul, the global tech giant could [potentially] bring all of that money back to the U.S., where it’s expected to pay a much lower corporate tax rate of just 21 percent (down from 35 percent, previously).

While it’s not 100 percent set in stone, and effective tax rates can vary year by year, there’s no doubt that Apple will come out a winner in the end. What the company does with its liquid capital remains to be seen, but it stands to reason that we’ll see a continuation of large-scale investments in U.S. manufacturing, job creation, and the development of new and advanced technologies right here in the U.S.

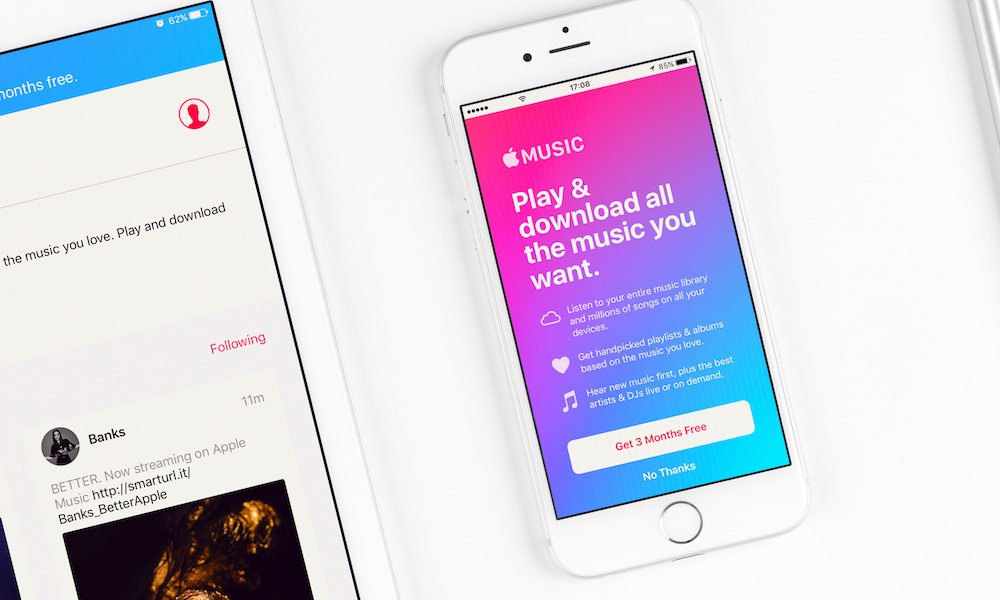

2 Services Growth

While the iPhone is arguably Apple’s most successful product, accounting for an estimated 63 percent of its annual revenue, following closely behind is the tech giant’s Services business.

Comprised of key, Apple-branded internet services including iTunes, the App Stores, Apple Music and more, Cupertino’s services business saw an impressive 23 percent growth spurt in 2017, alone. And the trend is only expected to continue in 2018, as the company places a renewed focus on Apps, original content creation and even physical device repairs in an attempt to bolster its user base.

1 Brand Value

According to rough estimates, the Apple brand is worth just over $184 billion. What’s so significant about that, of course, is that brand popularity often tends to correlate with continual sales — customers who buy an Apple product like iPhone, get hooked on it, and develop and affinity for it over time, going on to purchase the next, and the next, and so on.

That’s good news for investors like Warren Buffett, whose firm Berkshire Hathaway, recently scooped up a whopping 133 million AAPL shares.