10 Apps to Improve Your Financial Situation

When it comes to our finances, most of us don't know exactly what we're doing. Unfortunately, this is something our schools probably didn't teach us — and let's face it, even if schools did teach about finances, we wouldn't have paid attention.

Still, improving our financial situation is a goal we should all have, whether you looking to have more money now or save to make sure you'll have money in the future.

Nowadays, it's easier than ever to spend money with just the tap of a button, which makes it a bit harder to control how much you're actually spending. Fortunately, there are plenty of great tools available to improve your financial situation and help you handle your money the right way.

But how can you get started? Well, the good news is that you don't have to do it alone; you can have all the tools you need right in the palm of your hand.

Whether you want to get out of debt or get ready for rainy days, the right apps can help you with everything you need, and we've gathered a few to help you out.

Read on for ten of the best iPhone apps to help you improve your financial situation.

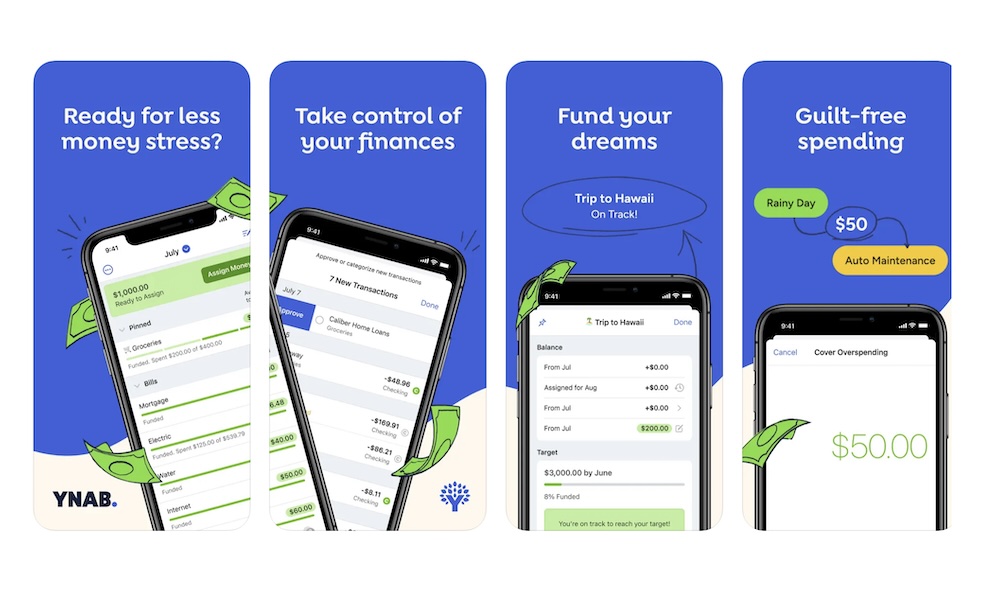

YNAB: Budgeting & Finance

Many people agree that if you want to have more control over your finances, you need to start making a budget. Now, that's usually easier said than done, but you can get a healthy start with an app like YNAB.

YNAB, which stands for "You Need a Budget," is one of the best budgeting apps you'll find on the App Store. What makes it so great is how easy it is to prepare you for future expenses you probably haven't even thought of.

This app focuses on zero-based budgeting, which means you grab your income and assign it to different categories until you have no more money to assign. YNAB calls this "giving every dollar a job."

You can create as many categories as you want, and the app will also suggest specific categories, like car payments or payments that you only do once every couple of months. By saving money each month, making a large quarterly or yearly payment won't feel as bad.

Then, instead of manually entering all your expenses, you can link your bank account to YNAB so the app registers all your transactions automatically.

Besides categories, the app also features reports to control where your money is going, show you what your current net worth looks like, and help you get your credit cards paid off — and keep them that way.

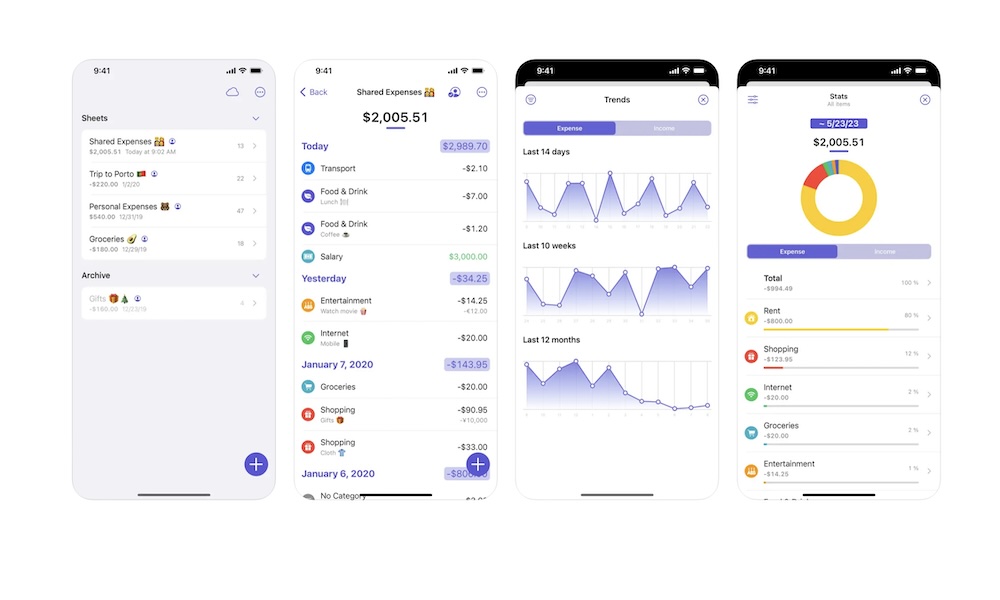

Expenses: Spending Tracker

Besides making a budget, you need to make sure you know where your money is going every month. Sure, apps like YNAB can help you do that, but if you want a simple and effective way to do it, you can try the Expenses app.

What makes this app great is how easy it is to start using it. You can record all your expenses in just a few moments, and you can install it on your iPhone, iPad, or Mac, so you can keep track of your money no matter which platform you use.

Another great thing about the Expenses app is that you can access all of its premium features with a single payment. Instead of a monthly subscription, you only need to pay once, which is really great for people on a tight budget.

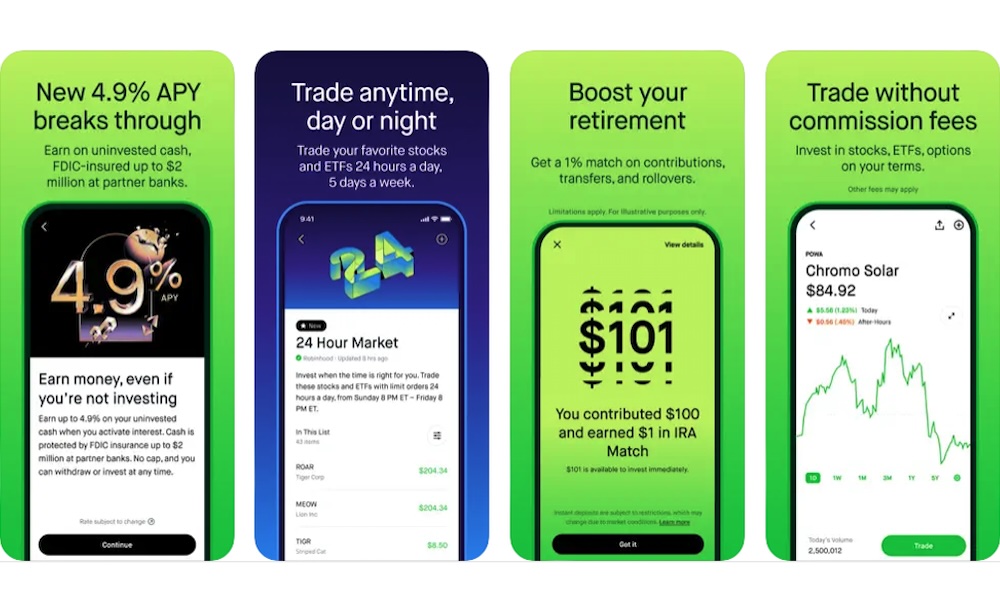

Robinhood: Investing for All

It's not just about how much money you have right now; you also need to start preparing for your future. After all, you probably don't want to be working for the rest of your life.

And one of the best ways to invest in your future is with Robinhood. Investing in safe stocks and exchange-traded funds (ETFs) is a simple and effective way to make sure your future self can have a bit of money without relying on anyone.

Robinhood makes this incredibly easy. Besides being able to invest in any stock you want, Robinhood helps you with your retirement by matching up to 1% on all the contributions you make.

Additionally, when you invest in Robinhood, you won't have to pay any commissions. When you invest $1 or $100, Robinhood won't ask for extra commissions on top of that.

And if you feel like you want more from the app, you can subscribe to Robinhood Gold, which will help you earn 4.9% interest on your uninvested cash and give you better tools to know what the market looks like before anyone else.

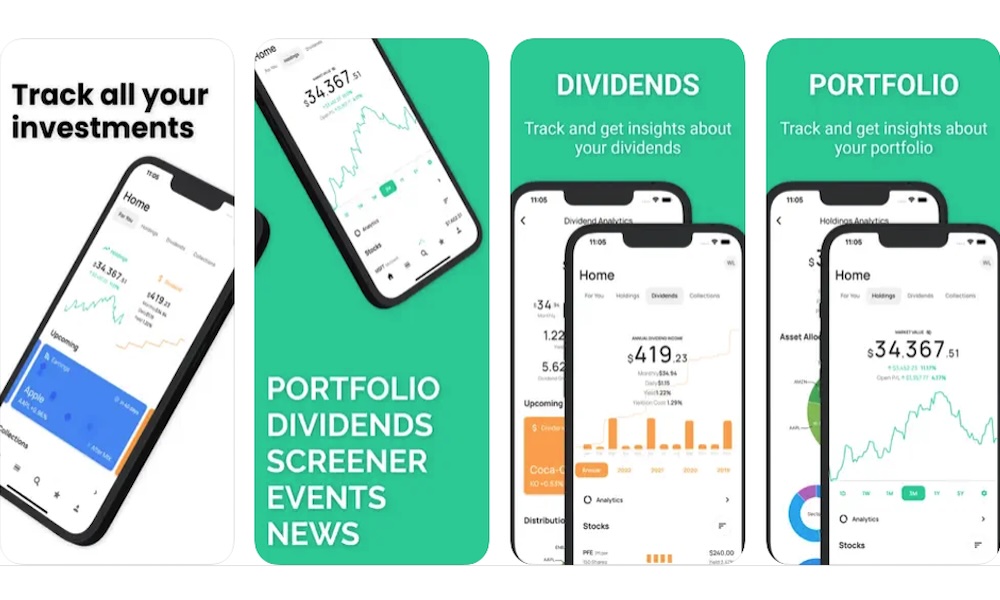

Stock Events Market Tracker

There are many ways to trade in the stock market, but if you want to keep track of all your investments, the Stock Events app is a great way to do it.

You can enter your entire portfolio into the app, keep track of its worth and future events in the calendar, and even create a watch list for stocks you may want to buy in the future.

Another cool feature that this app has is the ability to see what your dividends look like.

In case you don't know, dividends are basically something that a company will pay its shareholders just for having a share. It won't be much money, but it's always great to get paid for something you bought years ago.

With Stock Events, you can get an accurate number of how much you're earning from your dividends every year, month, and even day. Granted, unless you have a big portfolio, you'll only be making a few dollars a year, but it's a great way to keep you motivated and to remind you when you'll get paid.

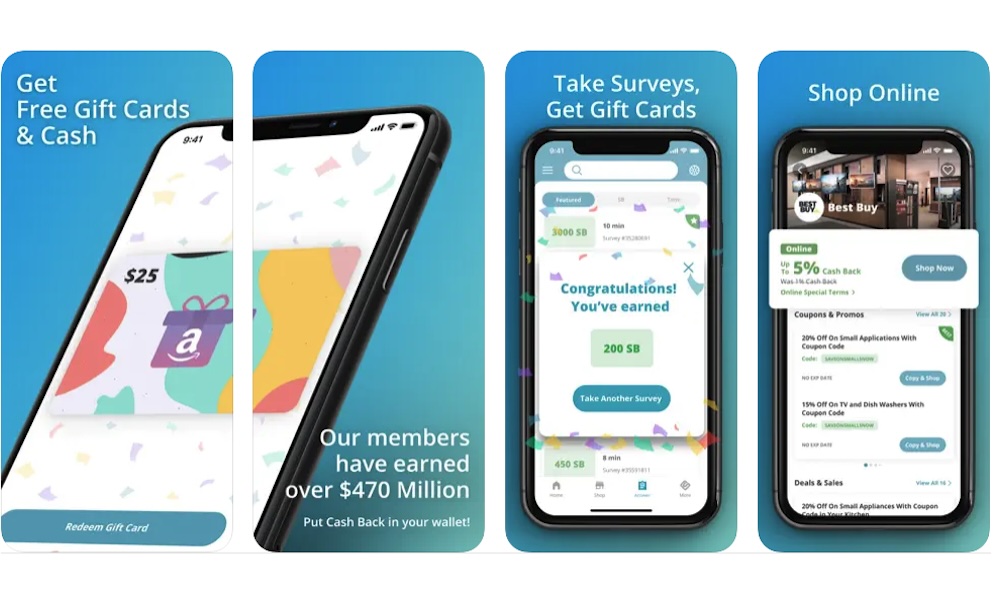

Swagbucks: Surveys for Money

These next couple of items on the list aren't exactly financial apps, but they might help you earn a little extra money for only a bit of extra work every day.

The first one is Swagbucks; this app has multiple users around the world, and combined, they have earned over $470 million. How did they do it?

Swagbucks lets you complete surveys or do specific activities that will earn you money. Each survey only takes a few minutes, and you'll get a few cents in return.

Granted, you won't make millions with the app, but you will have a bit of beer money, and that's always helpful.

Besides surveys, you can also scan your grocery receipts and earn cash back or exclusive coupons to save money later. You can also buy online in specific shops and earn a percentage in cashback.

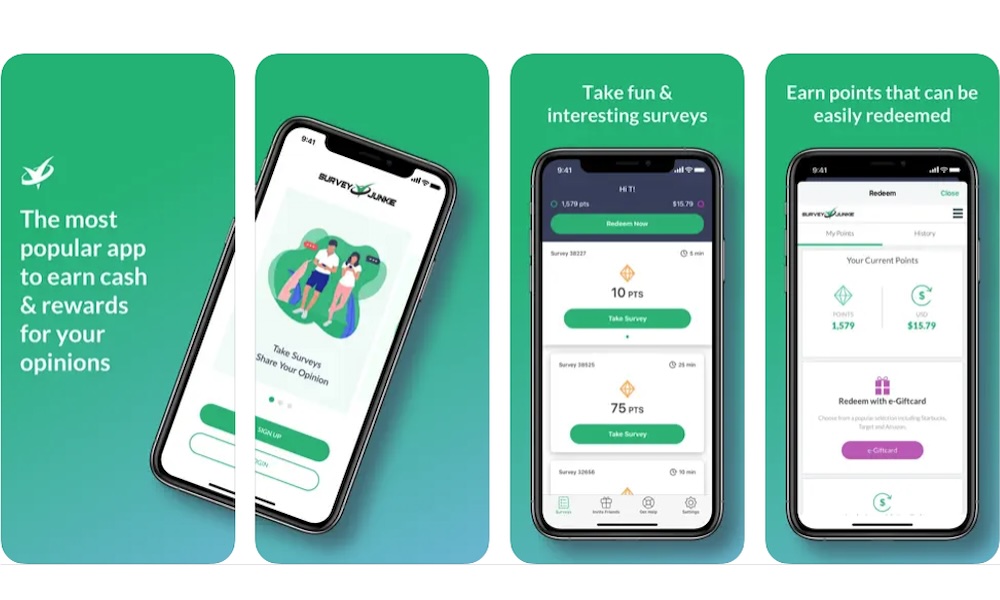

Survey Junkie

Another app that can help you make a bit of extra money is Survey Junkie. While at its core, it works similarly to Swagbucks, you can use both to try to make a bigger side income.

Just like Swagbucks, you'll also need to complete paid surveys. Each survey will give you a set number of points, which you can trade for cash, gift cards, or other benefits.

If you wait until you have 1,000 points, you can also make a direct transfer to your bank, so you have actual money stored safely.

Of course, if you don't want to wait, you can still get gift cards from some of the most popular places like Amazon.

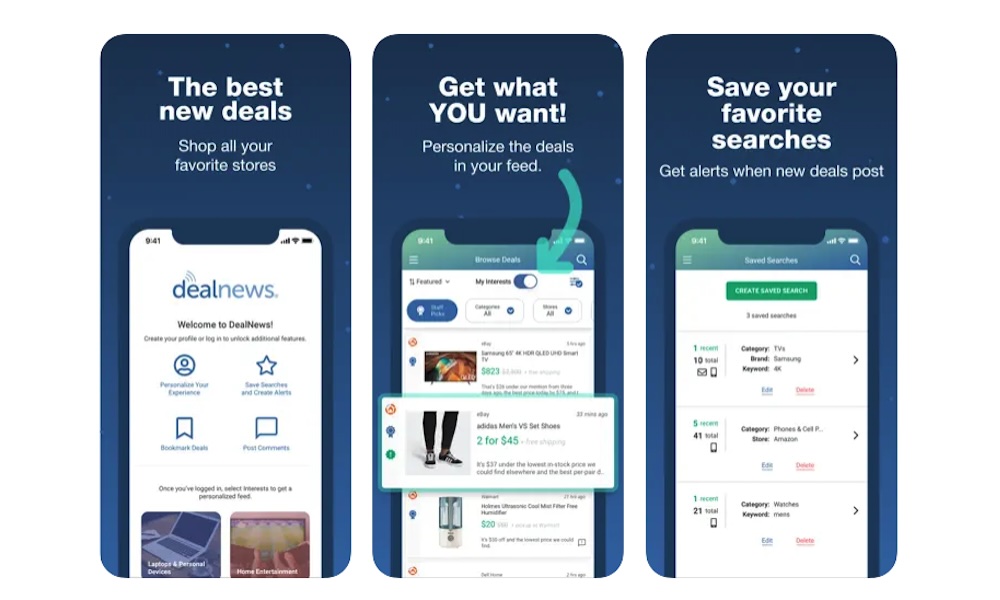

DealNews Deals & Coupons App

While making more money is always great, it also helps to try to spend less money. Sure, you can cut back on a few things every month, but it's also important to find good deals to make the most of the money you have.

Instead of scouring the internet endlessly to find these deals, you can use an app like DealNews to find all the best deals in the same place.

Every day, you'll find a list of the hottest deals available, which, according to the app, are found by "deal experts."

If you don't want to wait for a good deal, you can use the search bar and try to find a deal in a store or place you have in mind.

Besides deals, you'll also find coupons that you can save for later and use during checkout. There are many different coupons to choose from, so be sure to check the app regularly.

What makes DealNews great is that it also offers a lot of resources from experts that can potentially help you save money all year.

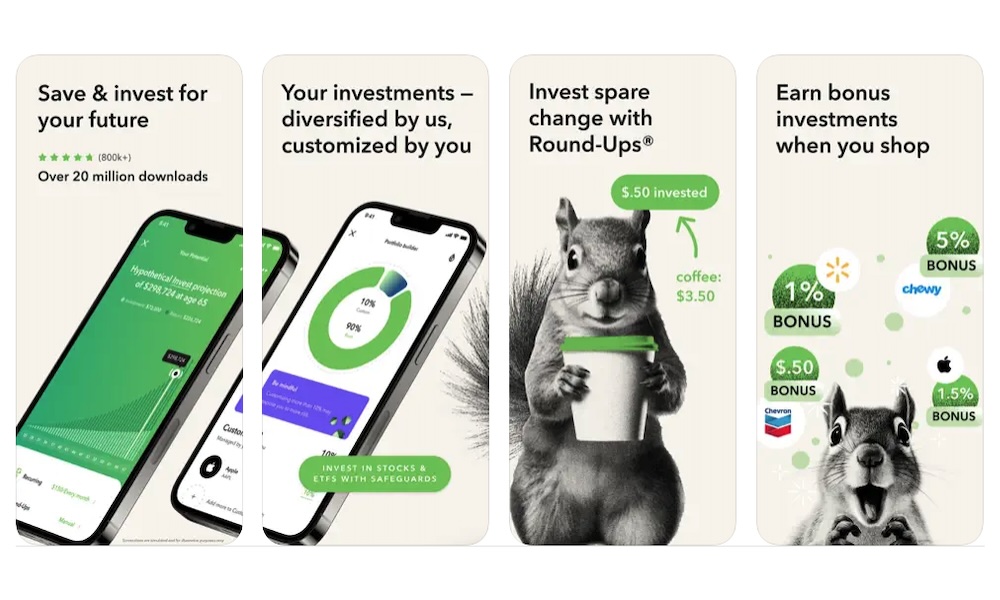

Acorns: Invest Spare Change

Acorns is another way to save, invest, and learn about money in the same places.

When it comes to investing, Acorns does things a bit differently, but it will make your life easier. For starters, you can connect Acorns to your bank accounts, and it can automatically grab your spare change and automatically invest it for you.

Don't worry; Acorns only invests in what it considers to be diversified exchange-traded funds (ETFs), which are considered to be a safer way to invest money.

Acorns also features a lot of extra content that can help you understand more about investing, money management, and saving.

Plus, you can even earn exclusive rewards. There are over 15,000 brands available in the app, so you're bound to find a good deal to help you save more money for investing.

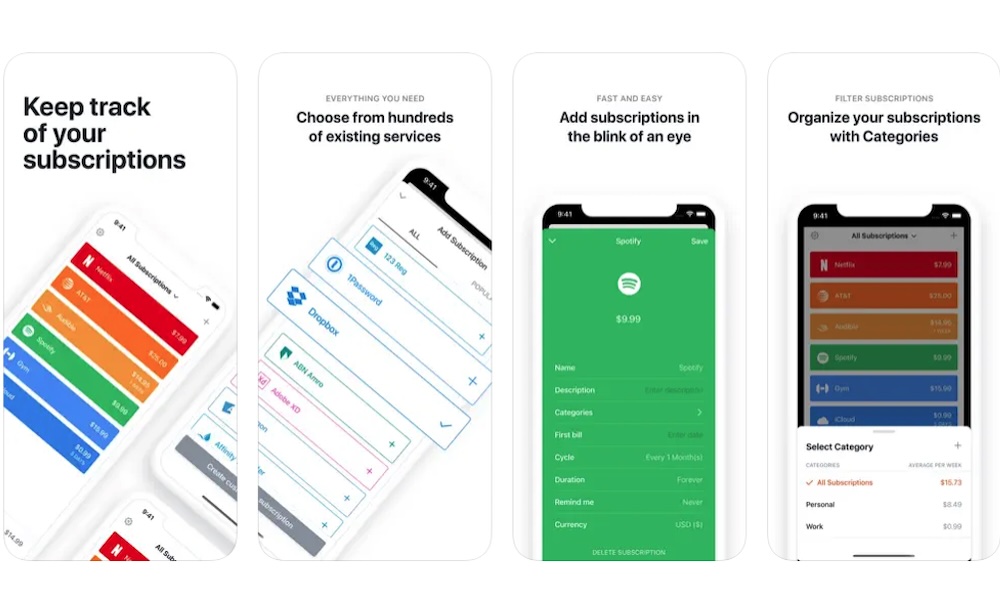

Bobby - Track subscriptions

Let's face it: we don't always use all of our subscription services, and if you're like many people, there's a good chance you're subscribed to at least some services you don't really need.

While this is normal, keeping track of all the subscriptions you have can be tricky. Fortunately, there are apps like Bobby that can help with that.

Bobby is a simple but effective app that can help you track all your subscriptions. The app has hundreds of different registered subscriptions, so you're sure to find what you're subscribed to.

And if the app doesn't have the subscription you use, you can create it in just a few taps.

After you have all your subscriptions in place, you can organize them by category and check when you need to pay. But you won't have to keep that in mind, as Bobby will automatically notify you when you need to pay your bills.

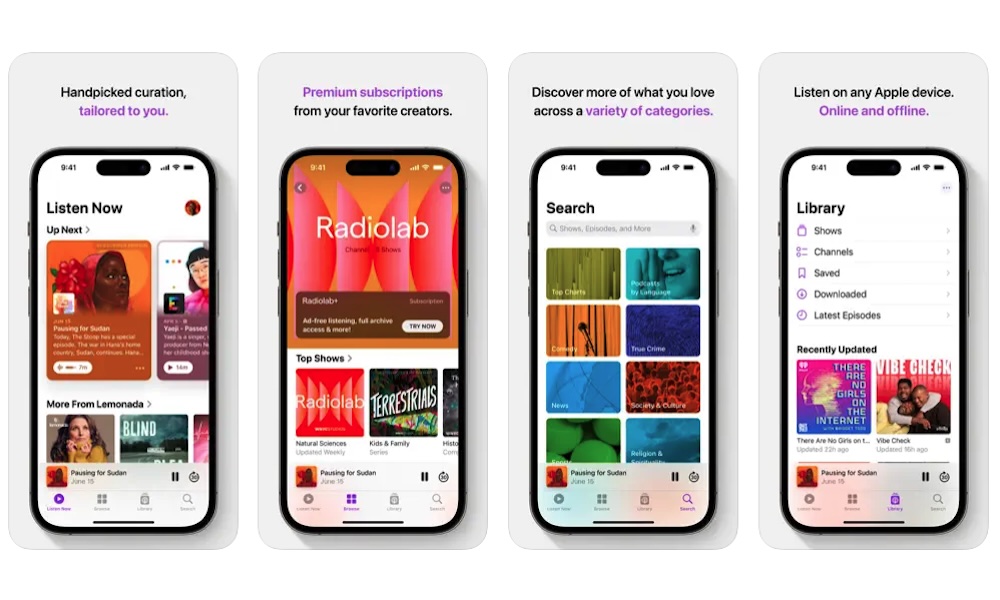

Apple Podcasts

When it comes to improving your financial situation, you probably didn't think of Apple Podcasts. But in order to know how to become better at handling your money, you need to learn from experts.

And fortunately, everyone has a podcast these days. You can find people who can teach you how to invest, save, and grow your money in Apple Podcasts simply by searching for them.

There are thousands of options out there, so be sure to check them out and find the ones that can teach you how to reach the goals you want to achieve with your money.

Besides that, you're probably familiar with all the features Apple Podcasts has. You can download episodes, subscribe to your favorite creators, and, best of all, it's completely free to use.