The Apple Card Savings Account Interest Rate Drops Again

Credit: Apple

Credit: Apple

Toggle Dark Mode

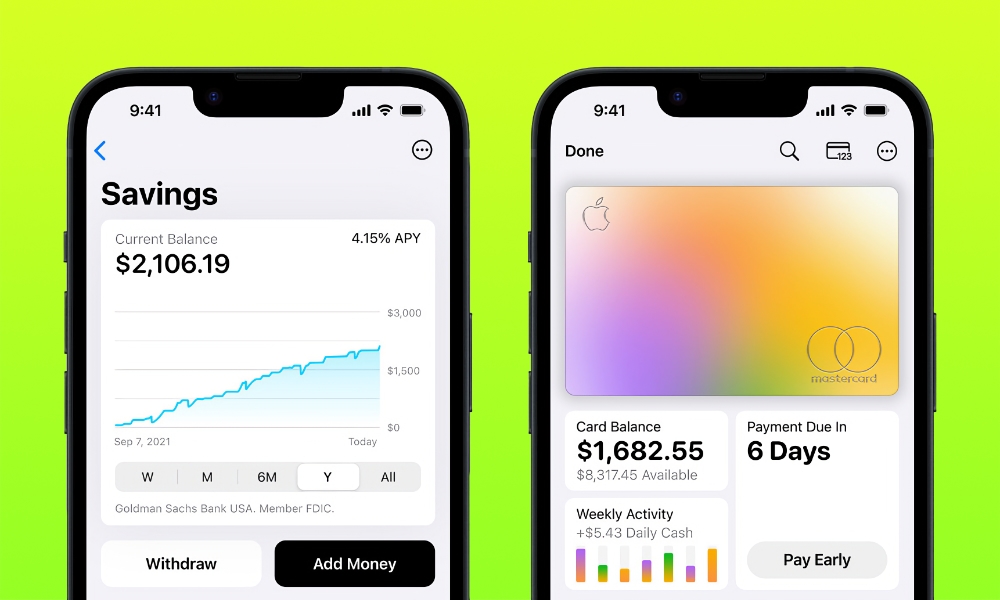

In early 2023, Apple introduced a new Apple Card Savings Account with an impressively high annual percentage yield (APY) of 4.15%, but that was just the beginning. Around the beginning of this year, we saw not one but three rate increases, bringing the yields up to a sky-high 4.5% APY.

While that wasn’t the highest rate of any high-yield savings account, it was very impressive for one that required no minimum balances or fees to achieve those rates. For example, while Apple was still paying 4.25% APY in December, Robinhood Gold had raised its APY to 5.0%. However, that rate was only available to subscribers willing to pay a $5 monthly fee; everyone else got a meager 1.5% APY.

That’s not to say that Apple’s high-yield savings account doesn’t have its unique requirements, but those won’t cost you anything. The primary one is that, as the name suggests, you must be an Apple Card holder to qualify. Every other listed requirement for an Apple Card Savings Account is identical to the eligibility criteria for getting an Apple Card in the first place.

Sadly, just like everything else in the market, what goes up must come down. In April, the Apple Card Savings account saw a drop to a 4.4% APY, and now it’s falling once again to 4.25%, according to a report today from 9to5Mac.

This shouldn’t come as a big surprise, as neither Apple nor its current banking partner, Goldman Sachs, is acting in a vacuum here — it’s simply market forces at work. The US Federal Reserve slashed interest rates by a half point last week — its first such cut since the early days of the COVID-19 pandemic — and most financial companies are following suit.

Nevertheless, 4.25% is a solid rate for what it offers. Like the Apple Card, the Apple Card Savings account has no hidden fees, there’s no minimum balance required to get the best interest rates, and you can sign up for one right from your iPhone.

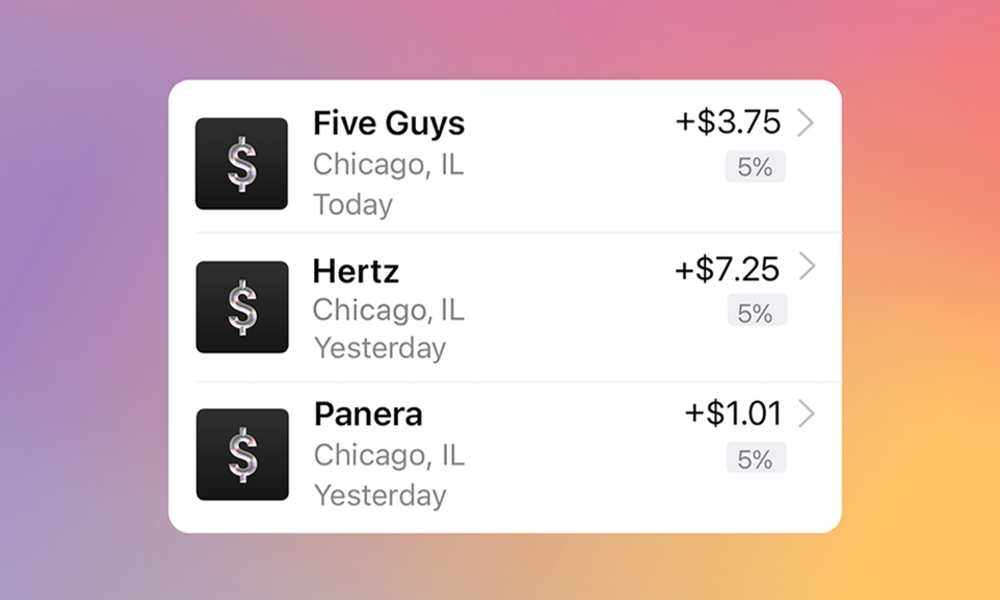

Perhaps the best part for Apple Card holders is that you can also direct all your Daily Cash — the 1–3% you get from purchases — into your Apple Card Savings Account, where it will begin earning interest immediately. That’s much better than the zero-interest Apple Cash account where it lands otherwise.

That makes the Apple Card Savings Account an easy choice for any Apple Card holder. Daily Cash has to go somewhere, and that might as well be an interest-bearing account. Even if you regularly move your Apple Card cash-back rewards to another account, most folks don’t do this daily.

Daily Cash isn’t the only way to get money into an Apple Card Savings Account. While the account is managed entirely through your iPhone, Apple lets you link it to an external bank account to withdraw or deposit funds through ACH transfers or quickly move funds to your Apple Cash card if you want to use it to make purchases.

For now, the Apple Card Savings Account is handled by Apple’s Apple Card partner, Goldman Sachs. However, both companies have been shopping around for an alternative, and a report earlier this week suggests that JPMorgan Chase could become Apple’s new partner next year.